Personal finance is boundless. Whether it is optimising expenses, savings, investments, all the way to FIRE, there is always something interesting to talk about.

As an analytical person, I like to track my financial situation to see how it changes every month.

You Can’t Manage What You Don’t Measure

Tracking expenses

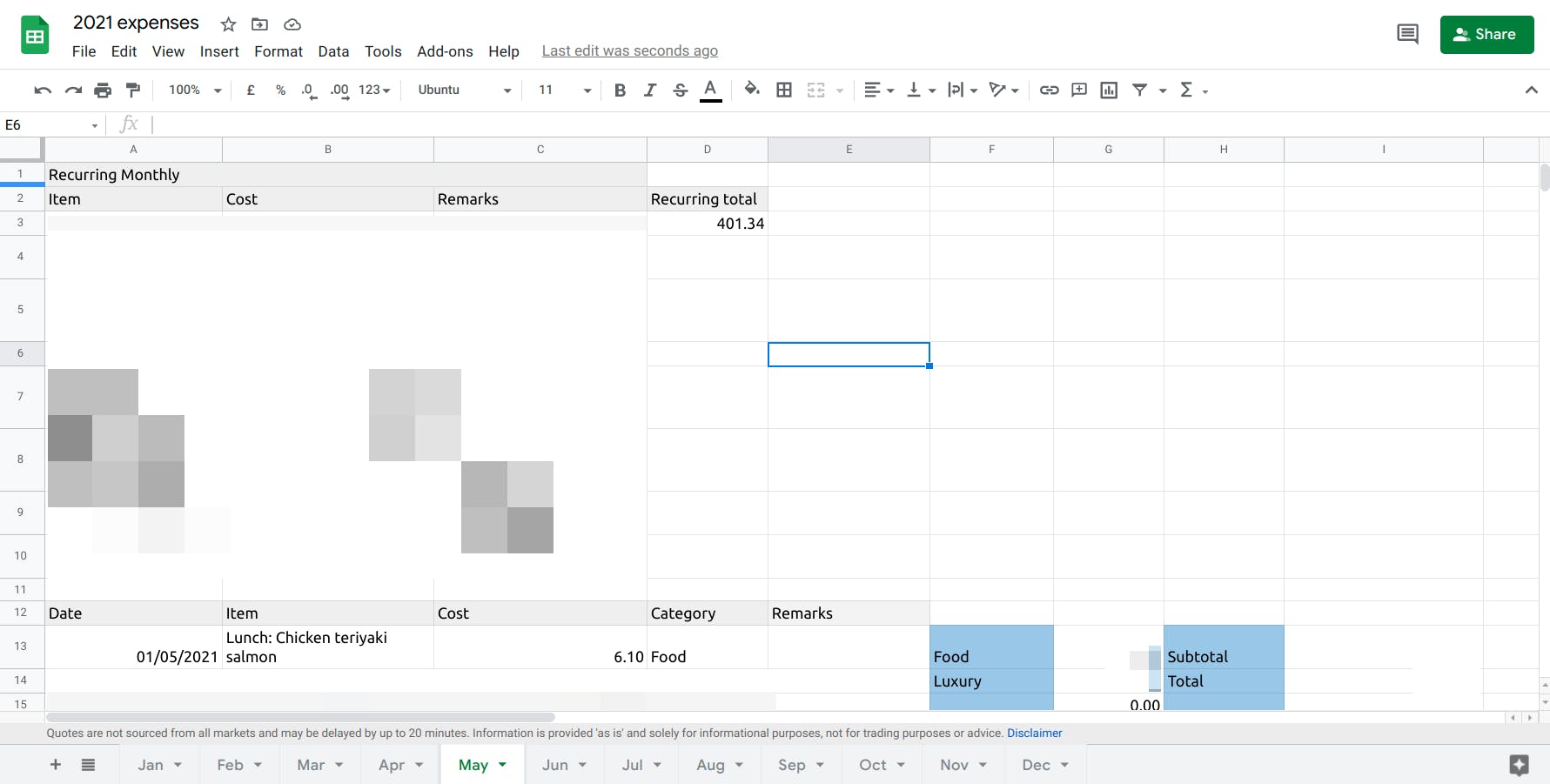

Without knowing much about personal finance at all, I started off by creating a simple monthly expense spreadsheet back in 2019, a few months before I started full-time work. It is really as simple as it can get.

Why not use an expense tracking app, or better, build one myself like a true techie would?

Because I just want to get started and I only need to know how much I spend every month. I don't need a data analysis pipeline, expense item categorization, or a nice-looking interface.

Monthly expenses

For monthly expenses, I broke it down by monthly recurring expenses such as transport, bills, insurance premiums and individual expenses.

There is a category column to display the total sum of each category.

The "Total" will be used to calculate the ratio of spending vs saving in another spreadsheet.

Tracking income breakdown

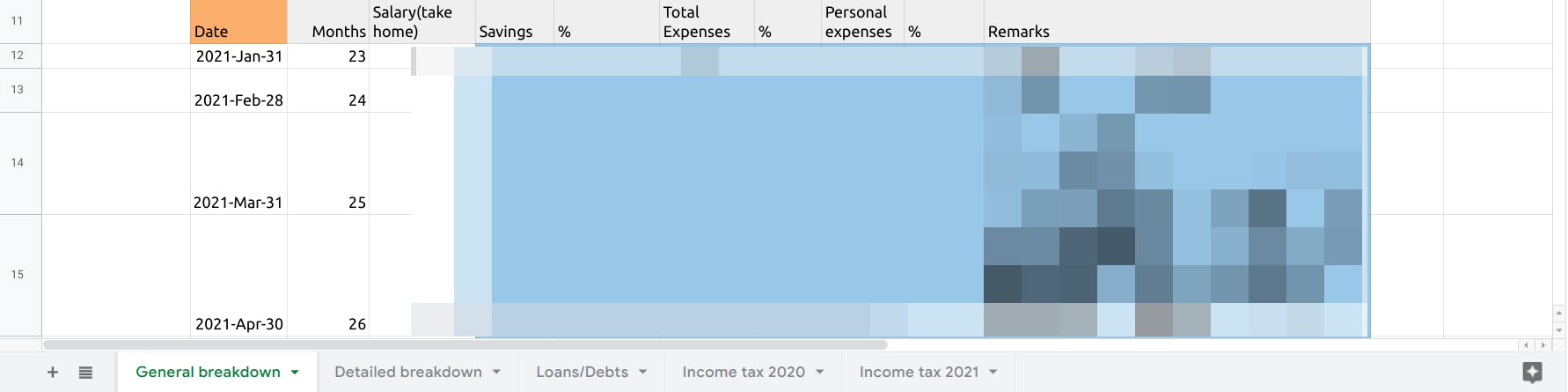

After getting my expenses down, the next step is to get an overview of the allocation of my monthly income - What proportion of the income is spent and saved

General breakdown of monthly income allocation

This sheet shows the general breakdown of the proportion of income saved, used for personal expenses and total expenses.

The cells in blue contain formula that will calculate its value based on other fields.

Here, the values are taken from another sheet called "detailed breakdown".

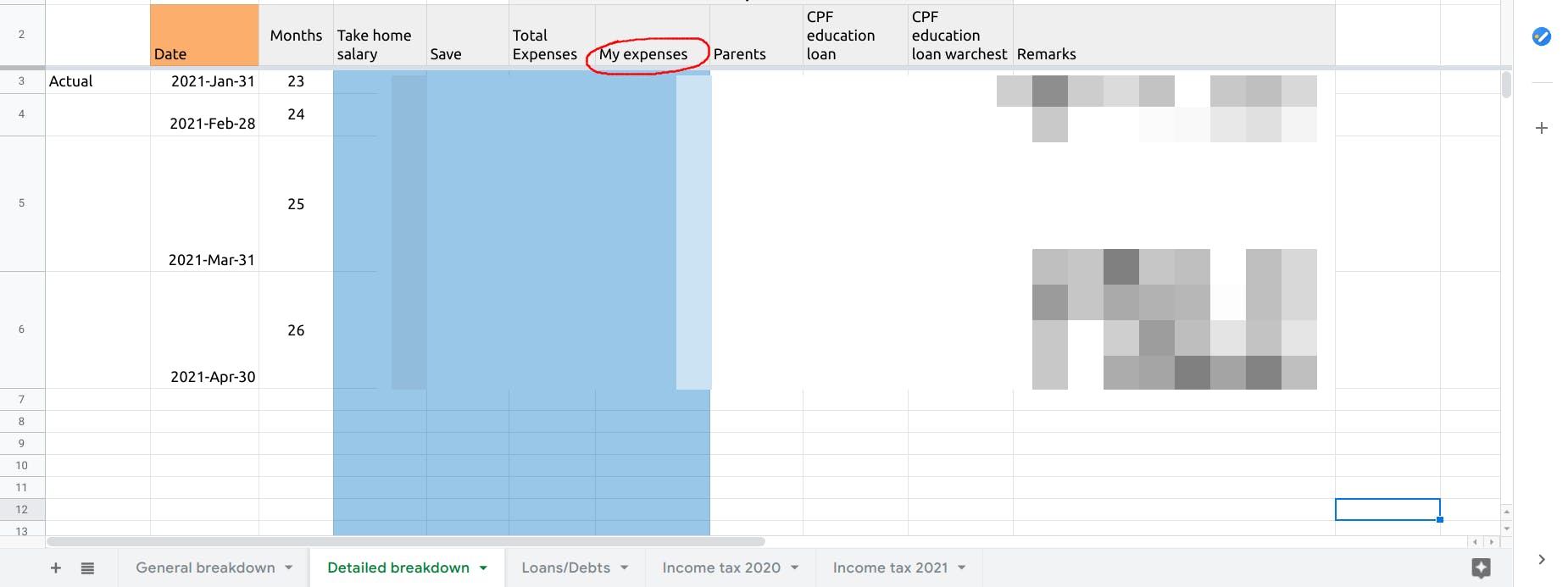

Detailed breakdown of monthly income allocation

This sheet is the detailed breakdown of my monthly income allocation. The "My expenses" column is taken from the monthly expenses sheet in the section above.

Here, I have columns for other expenses such as parents' allowance and study loan.

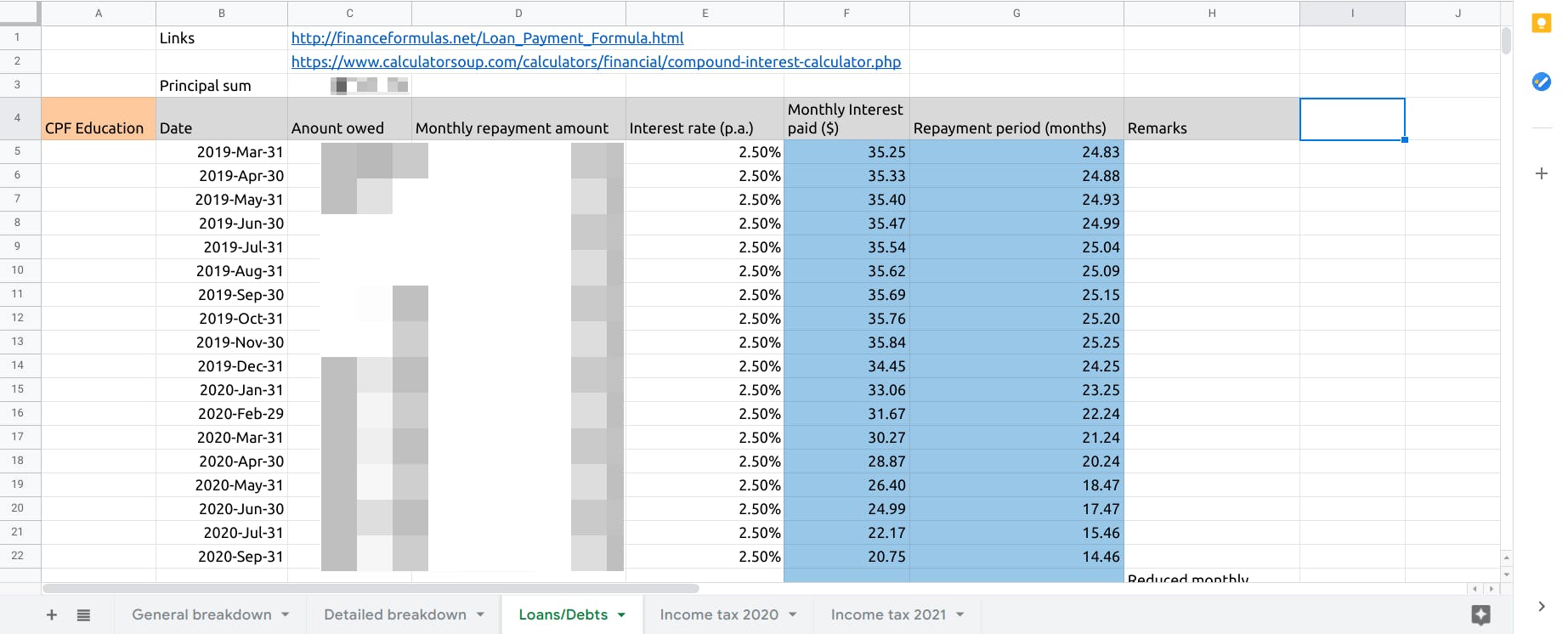

Study loan

I also have a sheet to track my study loan repayment using.

Tracking investment portfolio

With the expenses and savings portion out of the way, let's move on to the more exciting stuff - the investment portfolio!

I am a novice when it comes to investment. I dipped my toes into the world of stocks in 2020 May, and have little to no clue as to what I am doing.

Still, I wanted a simple way to track my portfolio without spending weeks or months trying to reinvent the wheel.

A quick search on google brought me to this incredible stocks portfolio tracker by Kyith Ng.

It has exactly what I need. I am able to list down the stocks that I want to track, enter the transactions, and look at the P&L of my portfolio.

It supports transactions in 3 currencies - SGD, USD, HKD.

Tracking net worth

Aftter handling my savings, expenses, stocks portfolio, the last piece of the finance tracking puzzle is to track my net worth over time.

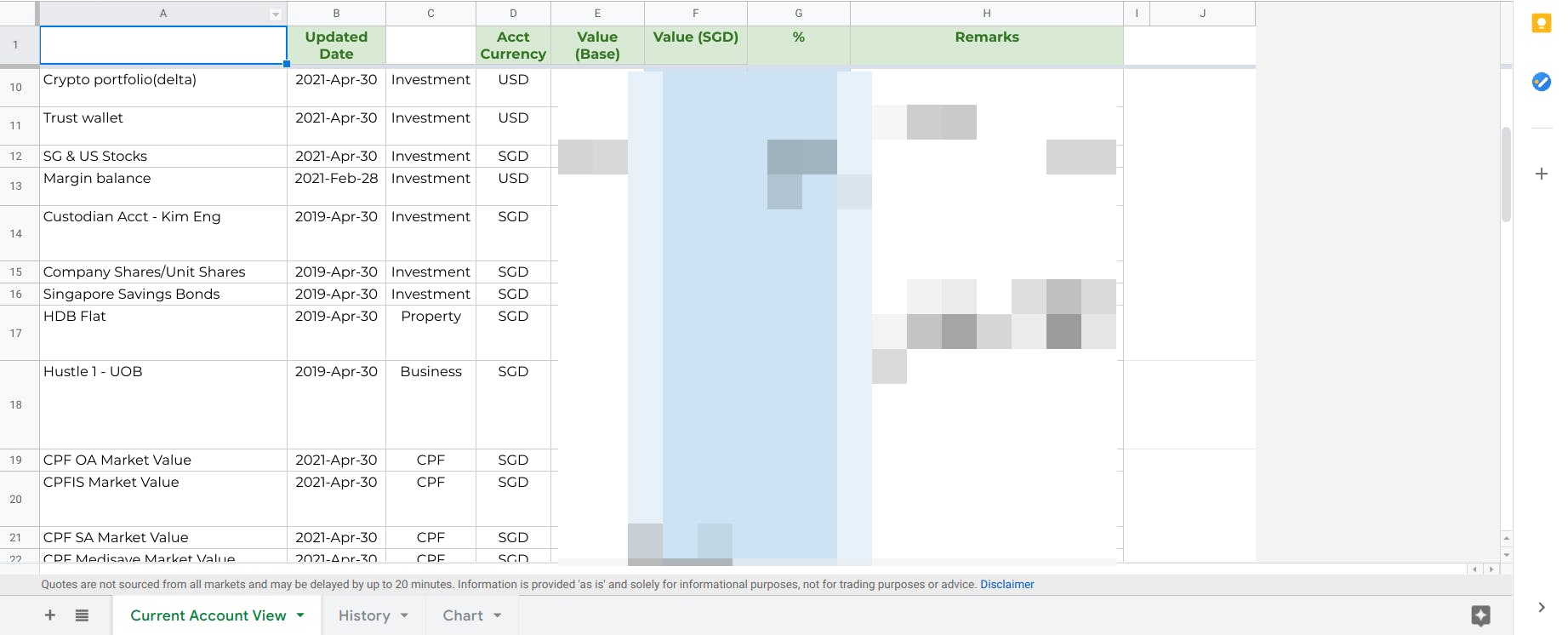

Once again, Kyith saves the day with his powerful networth spread sheet.

The idea is to gather all your accounts(business, cash, investment) in one place, aggregate them and track how it changes over time.

Track the value of all accounts in one place

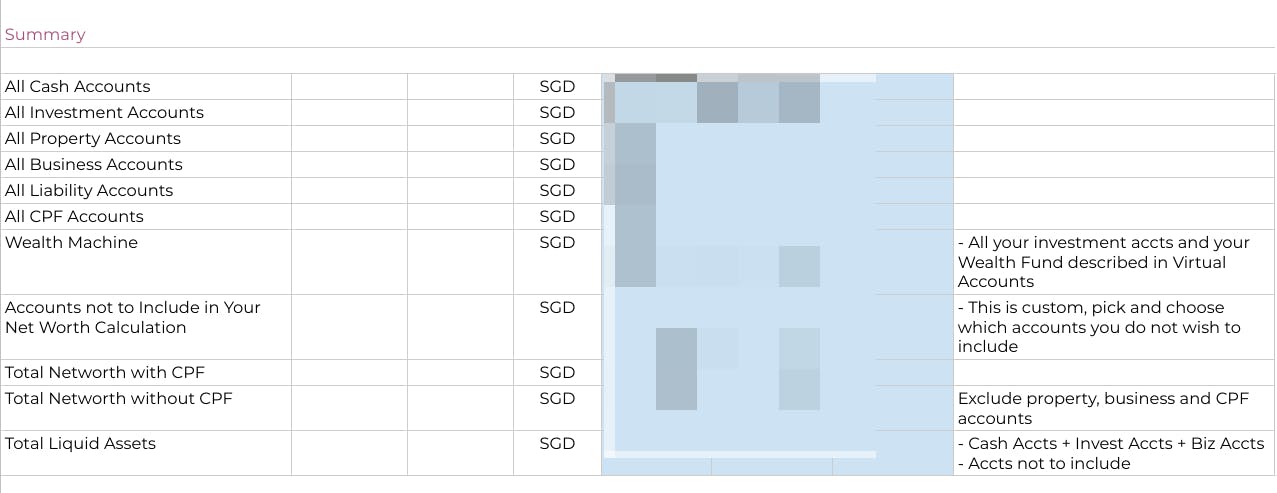

Summary of accounts

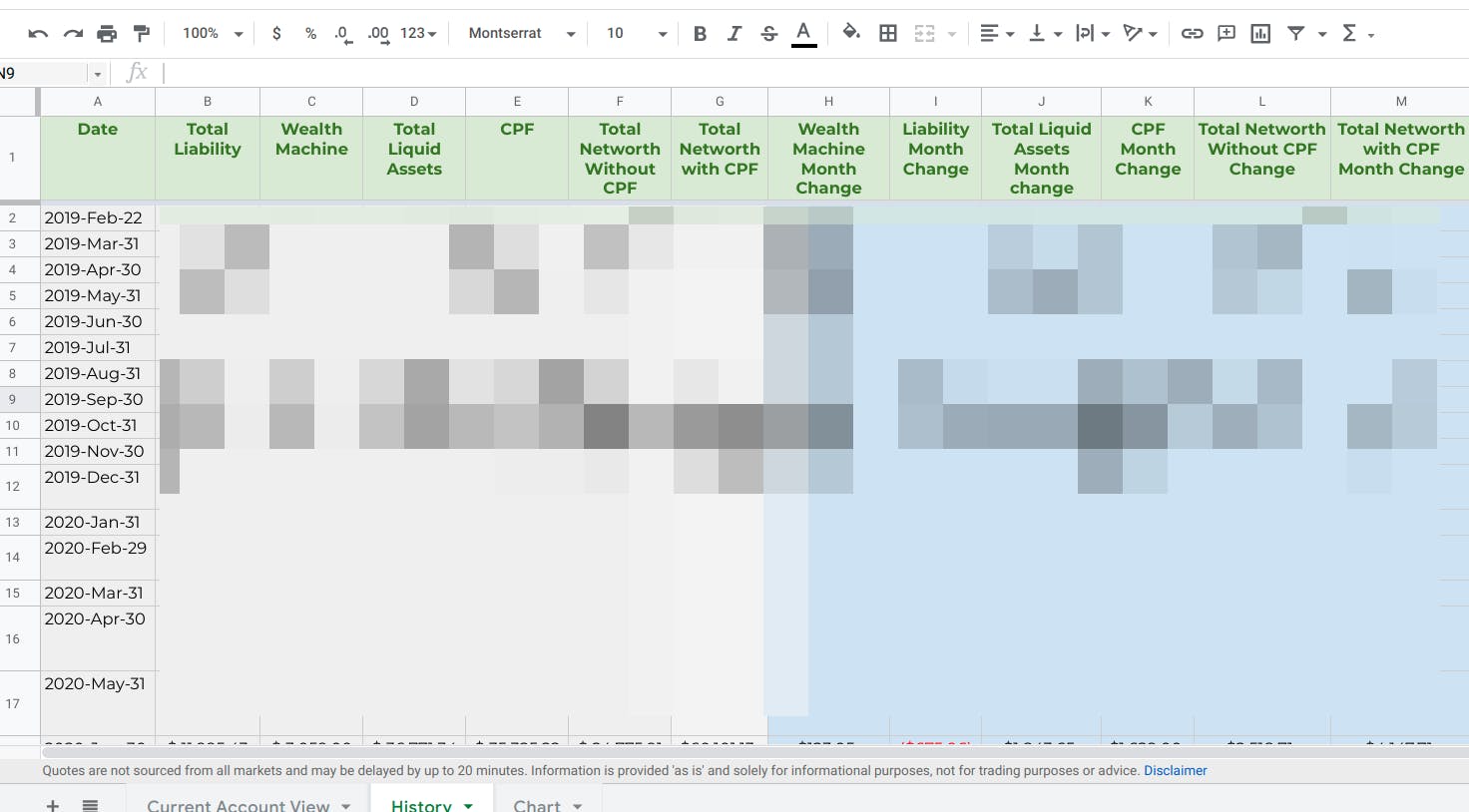

In this history sheet, the values are taken from the summary section in the current account view sheet.

Track changes in networth every month

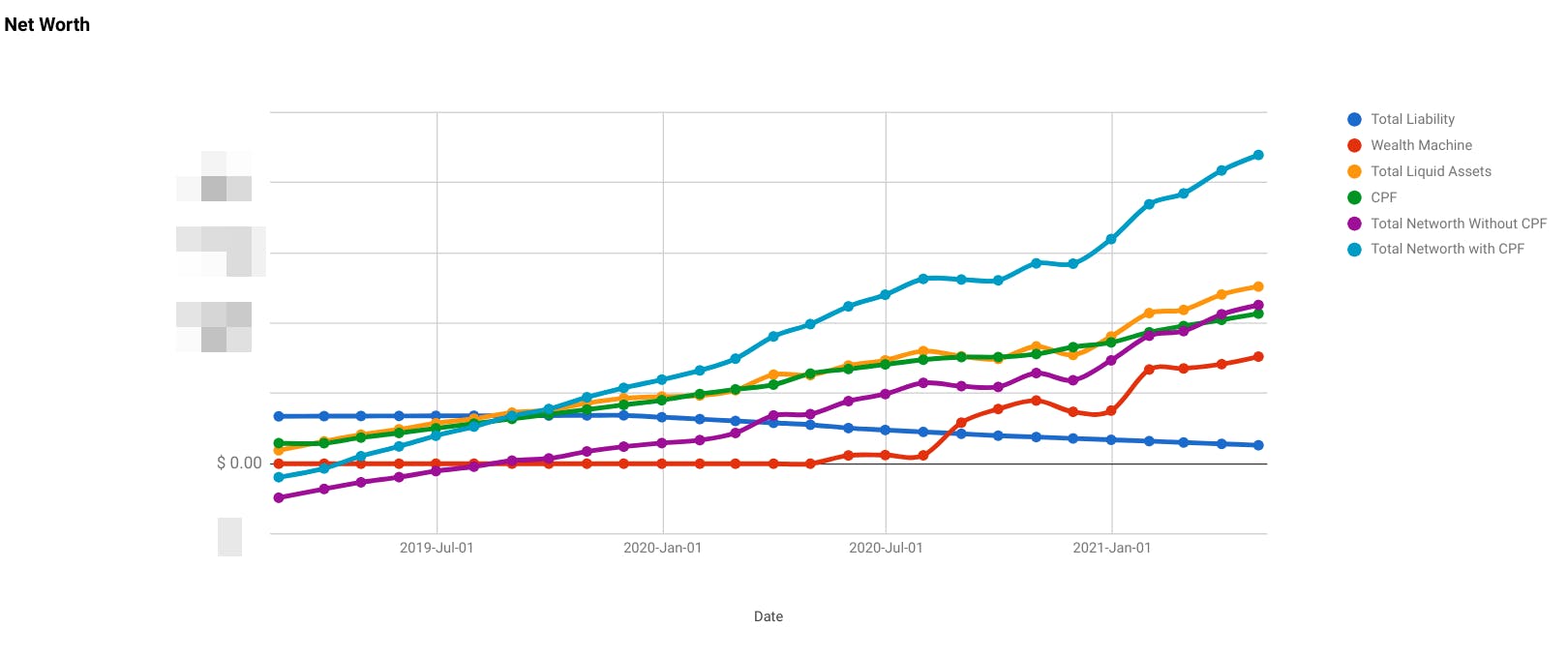

Finally, there is a charts sheet to visualise the networth over time, which is a fun way to keep things interesting.

Tracking portfolio alternative: InvestingNote

InvestingNote is an investment community that offers stocks portfolio tracking, charts, stocks screener, general chat and interest groups.

I mainly use it for portfolio tracking, and interest group discussion, that's about all.

One cool feature that I discovered recently is the stocks calendar. It shows a list of corporate events such as dividend schedules, financial result reports, etc.

In my opinion, the community is useful for casual chats, sharing of ideas. As with social media outlets, a large proportion of the user-generated content won't be useful to any particular individual.

Tracking portfolio alternative: StocksCafe

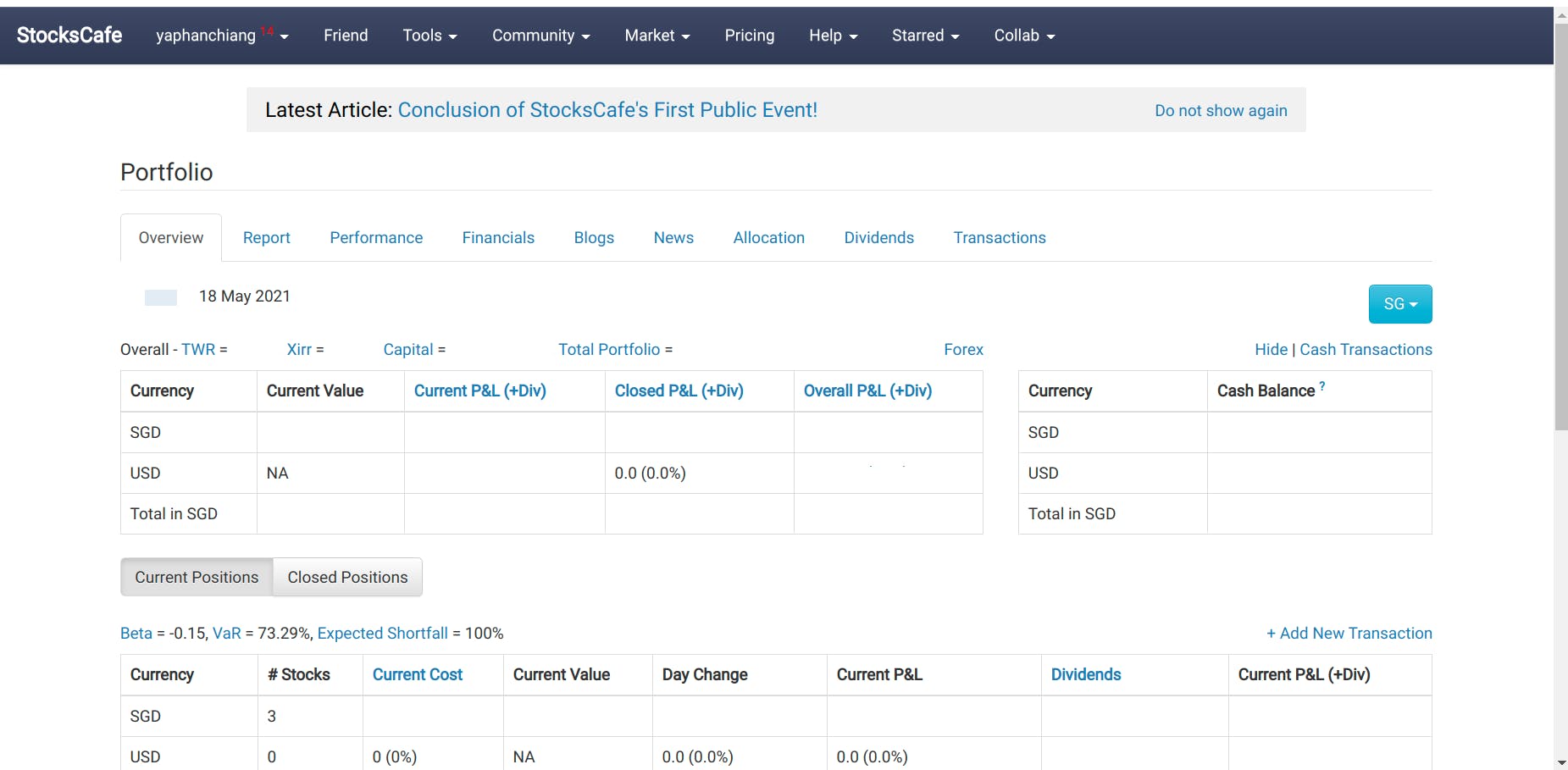

More recently, I discovered StocksCafe, a portfolio tracker developed by Evan Koh. It is an all-in-one platform that tracks your stocks and options performance, asset allocation, dividends, news.

Portfolio page

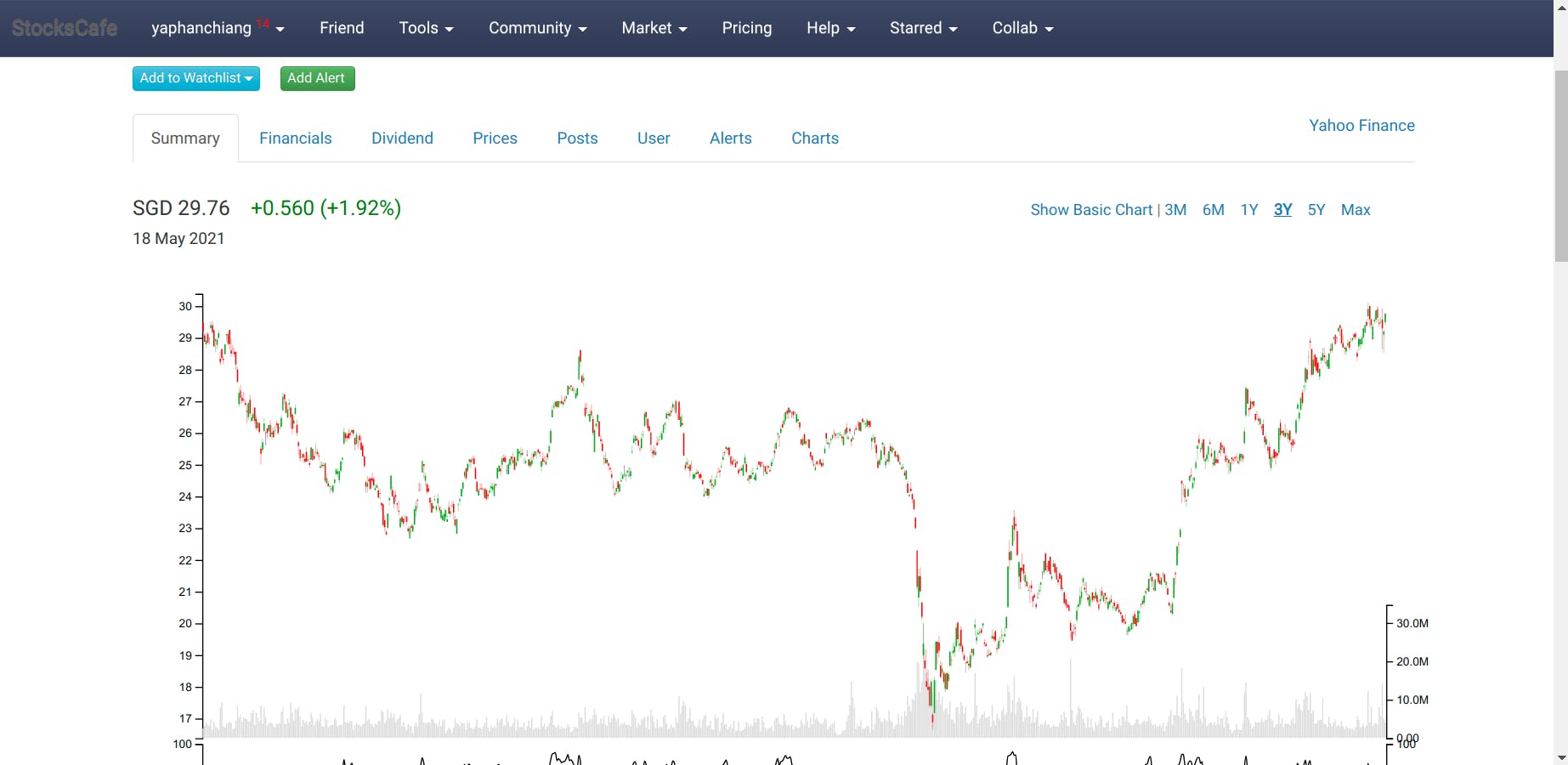

Of course, there is also just as much useful information for individual stocks.

Info on individual stocks

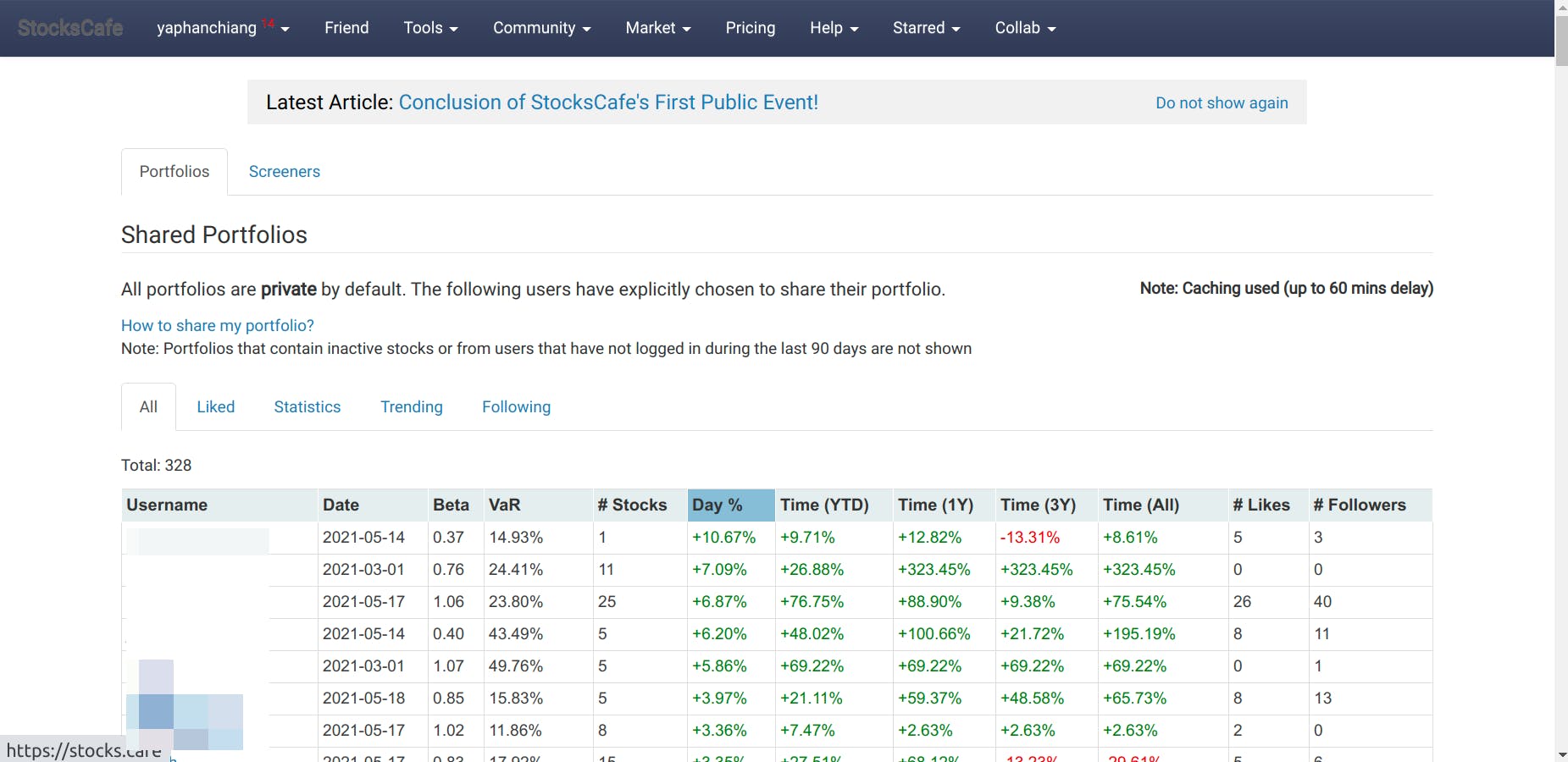

If you are looking for inspiration, there is a shared stock screener and portfolio tool that allows you to see the public screeners and portfolios of other users.

Shared portfolios

One cool feature of StocksCafe is the personalised feed, which consists of a daily summary of your portfolio, activities of people that you follow, news on trending and popular stocks.

Personal wall

When it comes to using a product, and deciding whether to make a purchase, one of the top indicators of consumer confidence is the founder's investment in their own product.

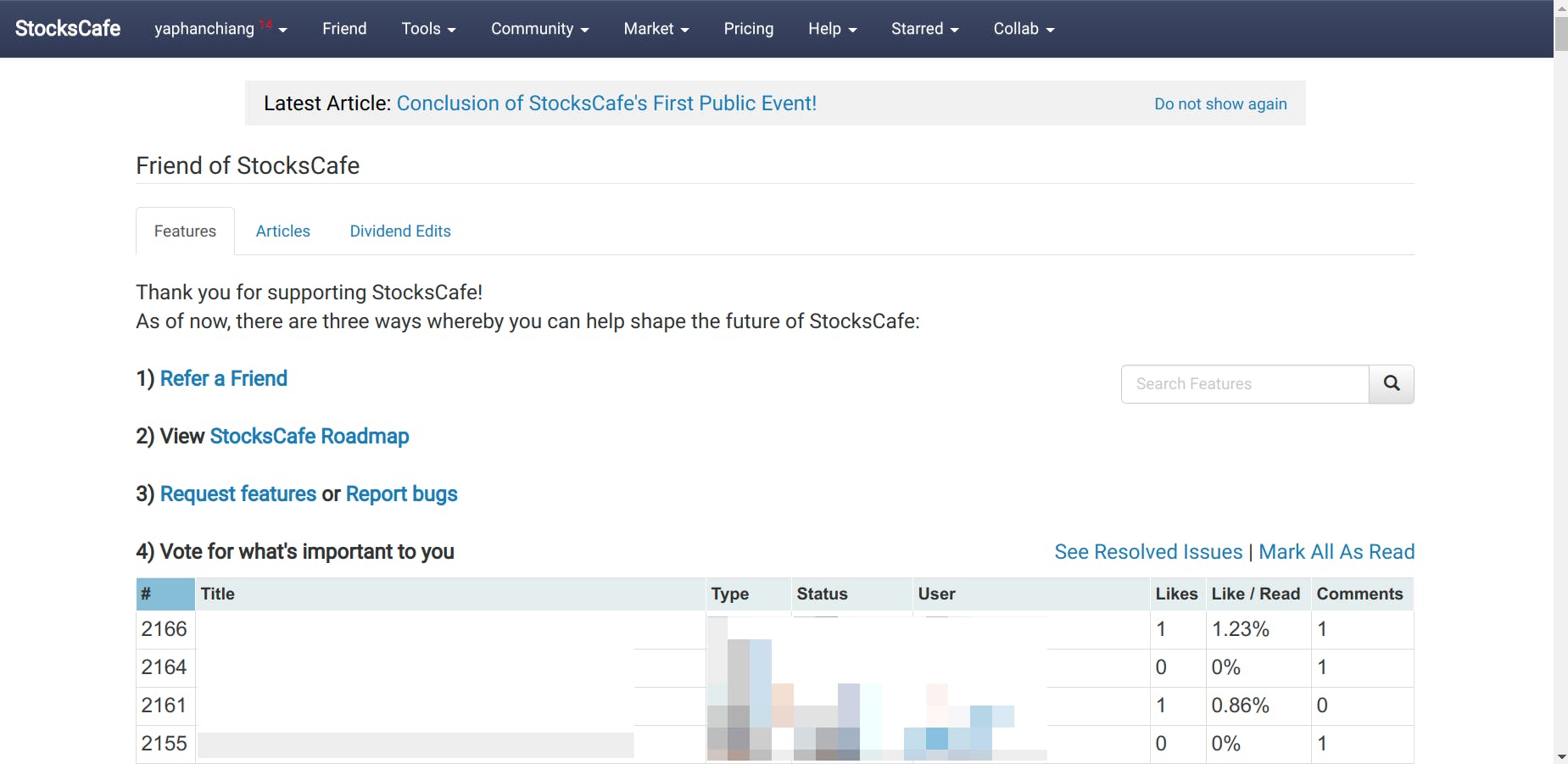

Evan is very active on the platform. He has put in place a roadmap, feature requests, and bug fixes so that StocksCafe can grow together with its users.

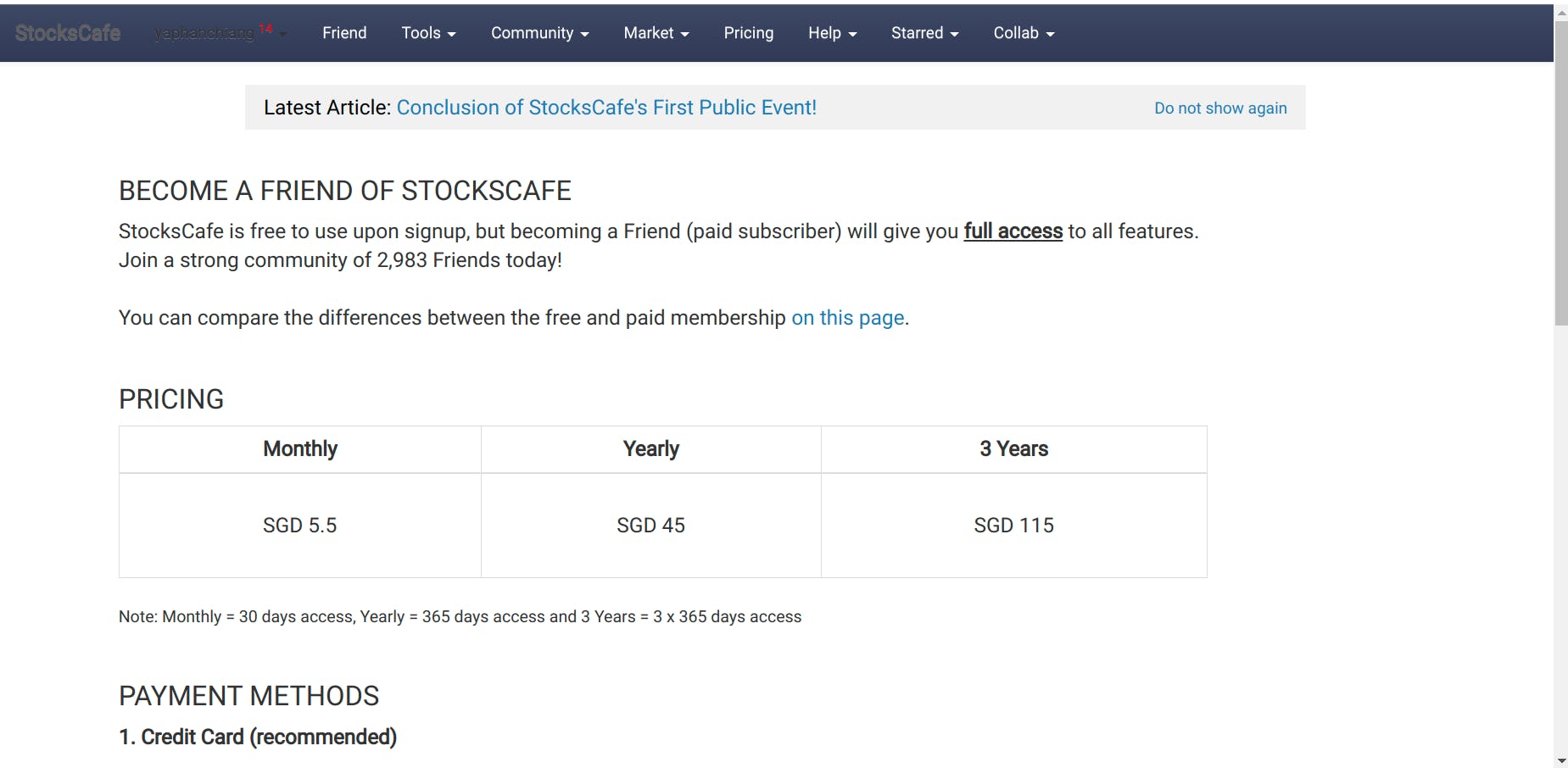

StocksCafe is free to use, and offers a membership option for full access to the platform. .

With just the features mentioned above, the membership fee is really a steal. As a software engineer, I feel that the amount of work it takes to build and maintain this platform justifies a higher price point.

Even if the price were to double, I will still gladly pay for it, knowing that the platform is here to stay for a good period of time.

Affordable membership fee

Finally, if you want to give StocksCafe a try, you can sign up with my referral link to enjoy all the features for 2 months. If you are happy with StocksCafe and decide to purchase the membership, I will receive 20% of the fee at no additional cost to you.

Conclusion

Managing finance is not easy, but it does not have to be complicated.

With a little research on how other finance enthusiasts manage their money, we can come up with a simple system to do the same for ourselves.